Innovative features that help achieve financial integrity

Financial features

The features below represent financially inspired characteristics of the ScramCard device.

Each feature delivers a method by which to address a financial exposure that would otherwise exist without it, with a variety of capabilities able to extend across multiple business lines.

As a consequence, ScramCard can mitigate financial fraud that currently exists during card-present, card-not-present and/or funds transfer related activity, all within a single product.

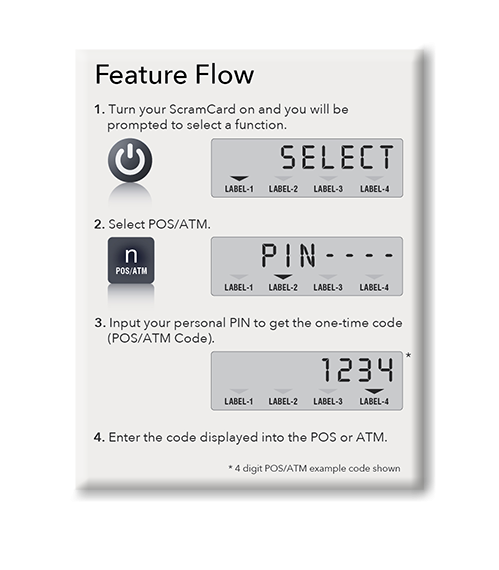

POS/ATM for devices without card linking

The use of a static PIN at a POS or ATM continues to represent poor security for card present transactions such as these.

ScramCard introduces the use of dynamic PINs and thereby strips any fraudulently extracted details from the ScramCard device of any secondary or intrinsic value.

PLAY VIDEO

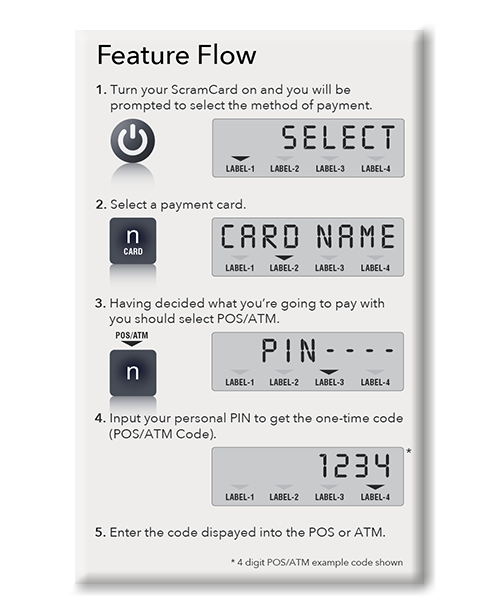

POS/ATM for devices with card linking

To suggest consumers take the necessary steps to prevent others from seeing the PIN they’re inputting at a POS or an ATM is not something they should be managing on behalf of their bank.

This also reinforces the view that the use of a static PIN is no longer a viable solution.

PLAY VIDEO

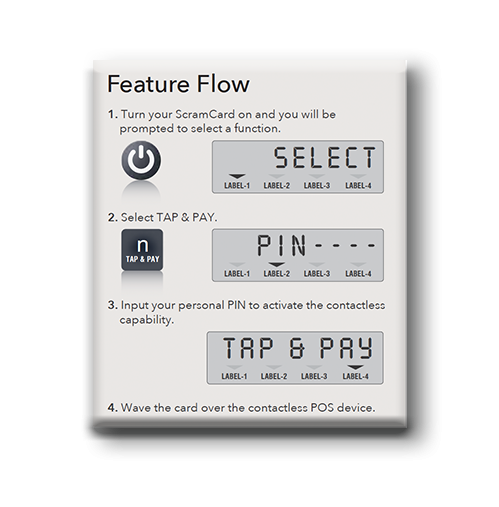

TAP & PAY for devices without card linking

Contactless payments are a convenience that customers are increasingly warming to but the value of a given transaction is limited due to the absence of any security.

ScramCard’s contactless PIN validation ensures that the convenience of such payments is not at the expense of security.

PLAY VIDEO

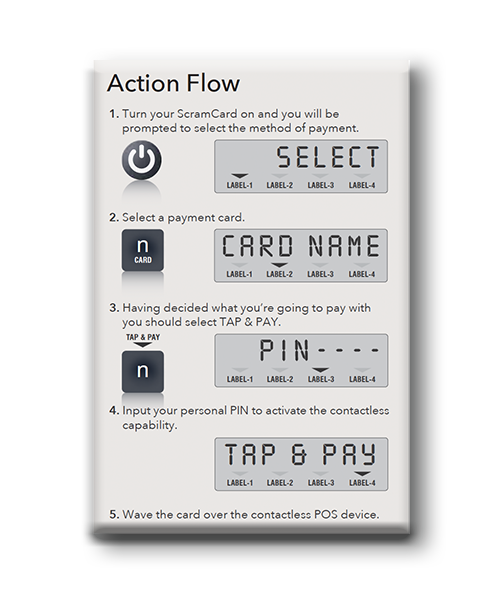

TAP & PAY for devices with card linking

ScramCard provides effective security for all contactless payments, utilising the funds from payments cards that would otherwise not have such protection.

The introduction of security based contactless payments reasonably substantiates justification for removing the low transaction limits.

PLAY VIDEO

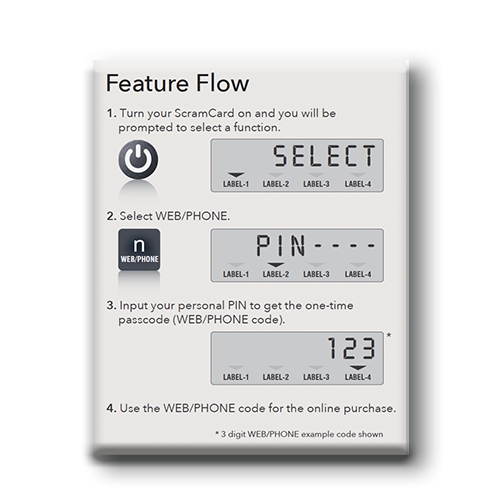

WEB/PHONE for devices without card linking

The introduction of dynamic security codes for online payments provides effective security for all merchants, without any need for changes to the shopping experience.

The introduction of this feature removes the risk associated with card-not-present transactions because the ScramCard is needed at all times.

PLAY VIDEO

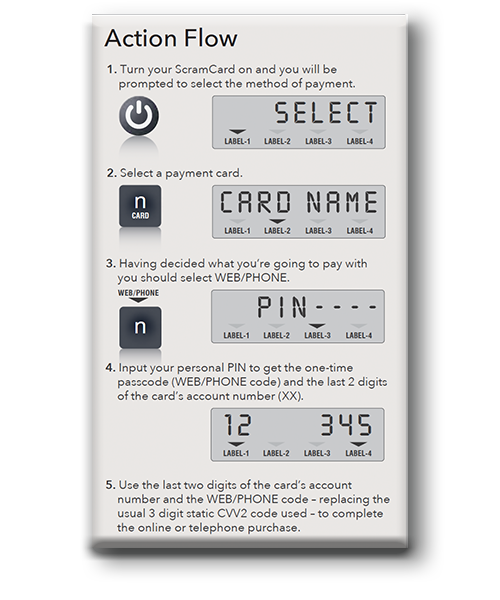

WEB/PHONE for devices with card linking

The introduction of dynamic security codes for telephone shopping negates the risks of the card details being used for fraudulent purposes.

The introduction of this features means that all methods of payment are card-present ones with card-not-present activity becoming a thing of the past.

PLAY VIDEO

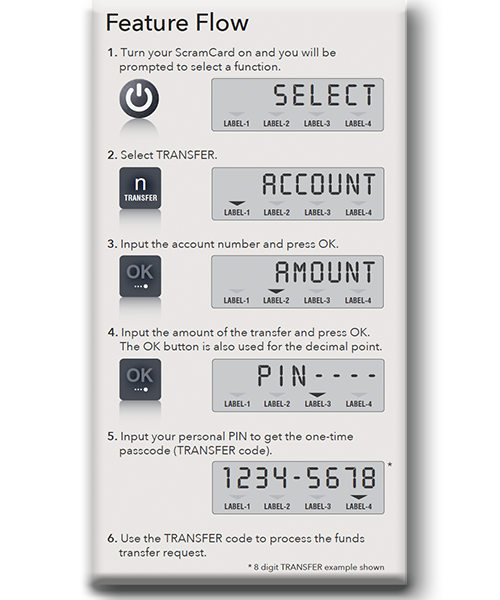

TRANSFER

Appropriate authentication and non-repudiation of funds transfers requires the use of a digital signature to underpin the transfer.

Meanwhile, the chance of this being adopted is commensurate with the likelihood of the consumer having the solution on them when the transfer needs to be done.

PLAY VIDEO

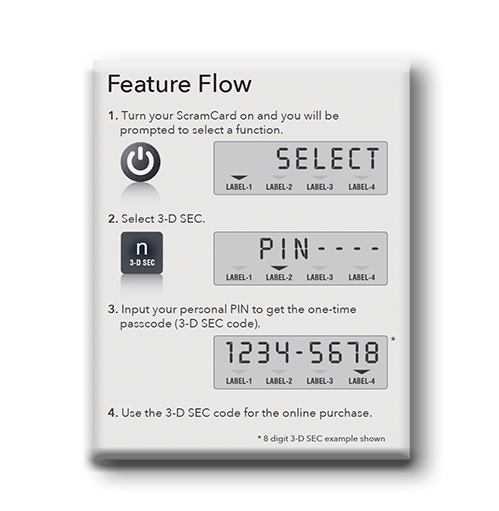

3-D SECURE

Abandoning of shopping carts because of long forgotten credentials can be easily rectified with ScramCard for the 3-D Secure payment protocol.

The use of a dynamic 3-D Secure Code alleviates the need for consumers to have to remember a password or credentials they may have thought of long ago.

PLAY VIDEO

Endless possibilities to gain a competitive advantage

If none of our four example propositions meet your requirements it is not to say that ScramCard isn’t for you.

While each proposition is defined by its core capabilities, each card can be completely reconfigured, both in terms of the UNIQUE functional, financial and authentication based features they provide and the buttons against which each feature operates.

Hence, nothing is fixed and the possibilities are literally endless for you to invent your own card proposition and go-to-market product.

“Rule No.1: Never lose money. Rule No.2: Never forget rule No.1.”

Interested in ScramCard? Enquire today